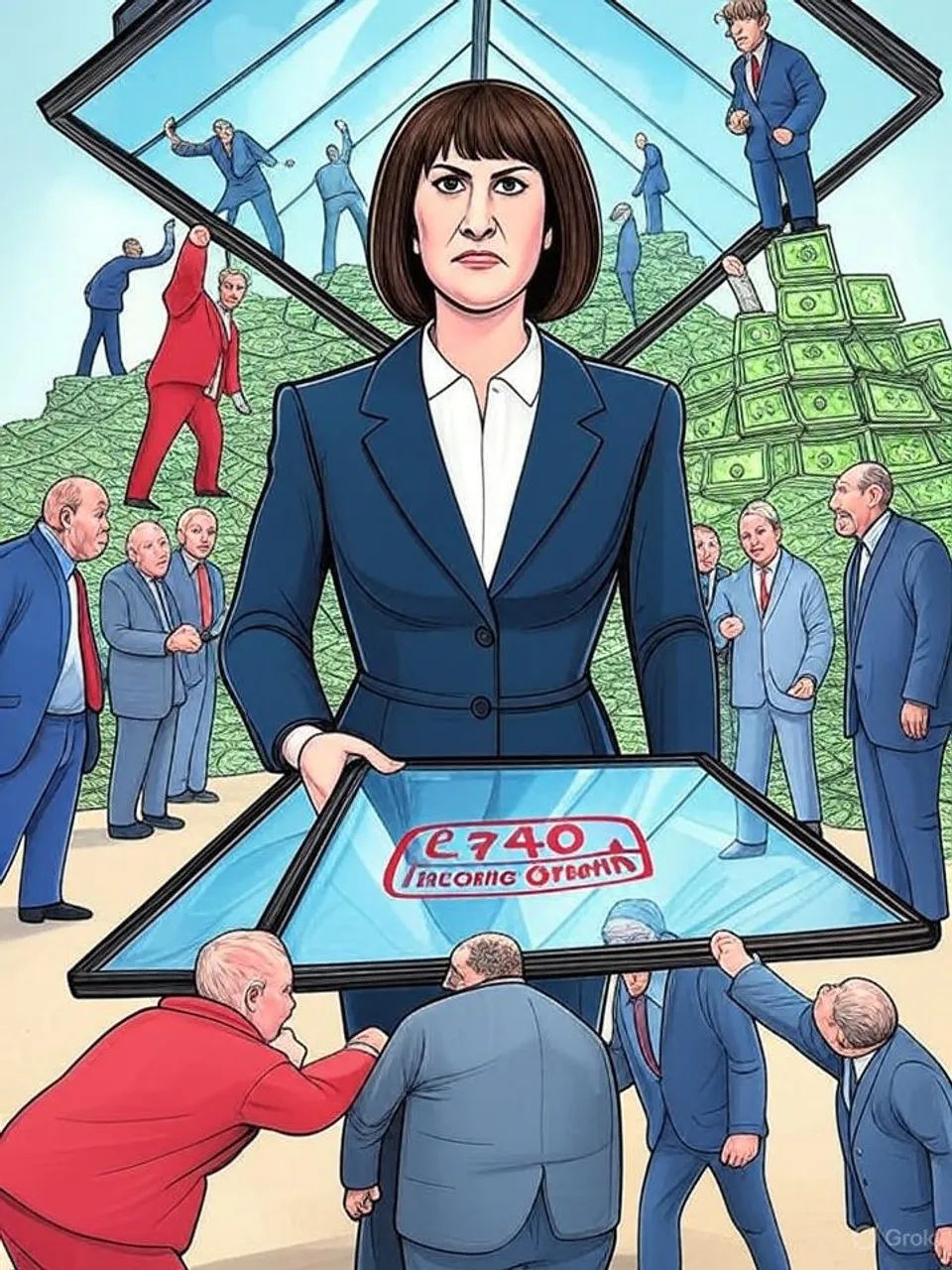

£740: Parliament's Income Growth Ceiling

Treasury data shows top earners lose £2,000, bottom 20% £200 as thresholds freeze

Rachel Reeves' Budget spreads tax pain across incomes despite rhetoric on the wealthy, netting tiny gains for the poor amid OBR's 0.5% growth forecast—the second-worst on record.

Rachel Reeves pitched her Budget as one where the wealthiest bear the heaviest load. Treasury data reveals the top 10% of earners face £2,000 annual income cuts by 2028-29. Yet middle earners lose £300 and the bottom 20% shed £200, undercutting the “broadest shoulders” narrative.

The income tax threshold freeze, extended three more years from 2027-28, drives this spread. Wages rise with inflation, but thresholds stay fixed. The OBR projects 780,000 more people paying tax by 2029-30, many starting from below the £12,571 personal allowance.

Pensioner households emerge as prime beneficiaries. Resolution Foundation analysis shows 56% gain from the package, outpacing the 33% of families with children. Scrapping the two-child benefit cap lifts average incomes in affected families by £5,310 yearly, but only for those with three or more kids—excluding most low-income households.

Offsets Fall Short

Fuel duty freezes and electricity bill reductions target living costs. Treasury estimates position these as bigger wins for lower earners, with the top 30% seeing minimal cash gains. IFS modeling of key measures nets the bottom 20% £220-£290 more by 2030-31, while the top 10% lose £700.

These figures capture only direct Budget effects. Broader economic performance dictates real outcomes. OBR now forecasts real household disposable incomes growing at 0.5% annually through Parliament’s end—£740 yearly in today’s terms per person.

That marks the second-worst parliamentary income growth on record. Resolution Foundation confirms the stagnation. Previous governments delivered better amid similar fiscal pressures.

High-value council tax surcharges raise £400 million yearly from 2029-30, joined by £2.1 billion from higher rates on property, savings, and dividends. National Insurance on workplace pension sacrifices adds £4.7 billion, hitting those with such schemes. Richer households own more assets, so they absorb most of these.

Yet the threshold freeze universalizes pain. Modest earners, squeezed by inflation, cross into higher bands without relief. This mechanism has operated across Labour and Conservative treasuries since 2010, steadily expanding the tax base.

Pensioner Priority Over Families

Budget math favors retirees over working-age groups. Pensioners gain from energy and fuel measures alongside tax tweaks. Families with children lag, with just one-third net positive.

Scrapping the two-child limit reduces child poverty by 450,000 by Parliament’s close, per government estimates. This expands welfare amid £18 billion prior surges. Costs fall on current workers via frozen thresholds and employer NI hikes.

Electric vehicle drivers face new mileage charges, offsetting fuel duty relief. Petrol car users with high mileage benefit more. Household specifics dictate winners—a low earner with two kids and a petrol car fares better than an EV owner in the same bracket.

UK growth forecasts underpin the squeeze. OBR downgrades deliver flat real incomes. Productivity stalls persist from pre-2008 peaks, untouched by party rotations.

Institutions treat low growth as inevitable. Chancellors adjust thresholds downward or freeze them, funding spending without overt hikes. Voters pay via erosion, not headlines.

This Budget exemplifies fiscal arithmetic over revival. Tax burdens spread thinly while benefits concentrate. Living standards inch forward at historic lows.

Reeves’ measures lock in decline. Ordinary households fund welfare growth amid 0.5% income rises. Power shifts costs downward; accountability stays absent across governments.

Commentary based on Who are the winners and losers from Rachel Reeves' Budget? at BBC News.