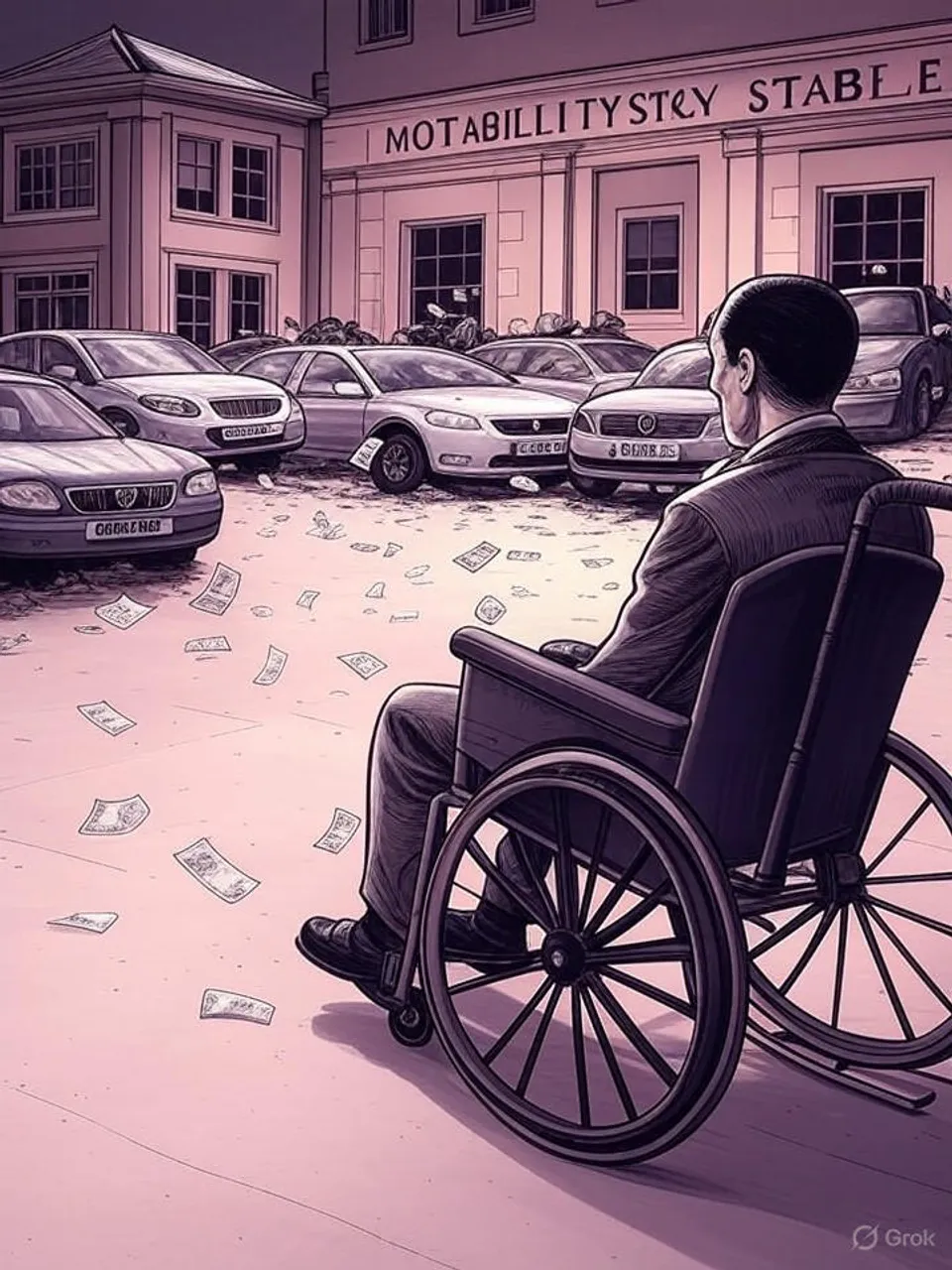

Eighty Sleuths Trail Stable Abuse in Ballooning Disability Fleet

£400 Tax Rise Hits Leases as Misuse Cases Multiply with Customer Surge

Motability's new investigations unit targets vehicle misuse amid stable rates and scheme growth. Labour tax hikes add £400 to costs, exposing welfare expansion that outruns controls across governments. Taxpayers fund unchecked vulnerabilities.

Commentary Based On

Liverpool Echo

Motability crackdown update as ‘Special Investigations Unit’ set up amid 'serve needs of disabled person' concerns

Motability appoints 80 investigators to hunt vehicle misuse, even as the operator admits abuse rates hold steady. Labour’s tax hikes will raise average lease upfront costs by £400 from July 2026. Taxpayers face higher bills to fund a scheme expanding faster than its controls.

The Motability Scheme leases cars to 750,000 disabled claimants using Personal Independence Payment mobility components. Customers select from thousands of models, including former luxury options like BMW and Mercedes until recent restrictions. Annual taxpayer cost exceeds £2 billion in benefit transfers.

Misuse breaches terms: vehicles must primarily serve the disabled tenant. Prohibited acts include unauthorized drivers, business use as taxis, or neglect. Yet Motability reports stable misuse rates amid customer growth, prompting the new unit and data-sharing with police.

Government removes VAT exemptions on advance payments and adds Insurance Premium Tax to leases. Minister Sir Stephen Timms calls this value for taxpayers, sparing existing leases and wheelchair vehicles. Labour MP Shaun Davies flags constituents with “questionable conditions” accessing cars beyond working families’ reach.

Blue Badge scandals amplify scrutiny. Tens of thousands withdrawn after deaths, with underground trading exposed. Cabinet Office Minister Josh Simons decries the erosion of “old-fashioned courtesy,” but parallel failures plague Motability oversight.

Expansion Fuels Vulnerability

Customer numbers swell disability benefit rolls. DWP data shows 3.5 million on PIP, up 50% since 2019 across governments. Scheme growth multiplies absolute misuse cases, stable percentages notwithstanding.

Tax changes follow Budget cuts to reliefs. Motability predicts £400 average advance payment rise over three-year leases. No-upfront-payment options dwindle to 40-50 models, squeezing access despite promises of continuity.

Cross-Party Inertia

Abuse detection lags for decades. Pre-2010 governments expanded entitlements without robust checks; post-2010 austerity trimmed edges but not bloat. Labour’s 2024 welfare surge to £18 billion extra buries prior reforms.

Investigators join late. Eighty staff target breaches, but scale pales against 750,000 vehicles. Data-sharing pledges echo unfulfilled past initiatives, from Blue Badge purges to gig worker raids.

Taxpayers underwrite it all. Benefit outflows fund leases, insurance, maintenance. Misuse diverts resources from genuine need, inflating costs without delivery on independence goals.

Functional governance demands upfront vetting. Sweden ties vehicle aid to audited usage logs; Australia caps models by income. UK opts for after-the-fact chases, perpetuating waste.

Ordinary claimants suffer. Legitimate users face tighter options and higher hurdles. Working families watch luxury access for disputed cases while their standards stagnate.

This exposes welfare’s core pathology: unchecked entitlement growth breeds abuse, tax tweaks chase symptoms. Politicians across parties promise dignity, deliver proliferation. Britain’s institutions reward volume over verification, stranding taxpayers in endless subsidy.

Commentary based on Motability crackdown update as ‘Special Investigations Unit’ set up amid 'serve needs of disabled person' concerns by Ben Hurst on Liverpool Echo.