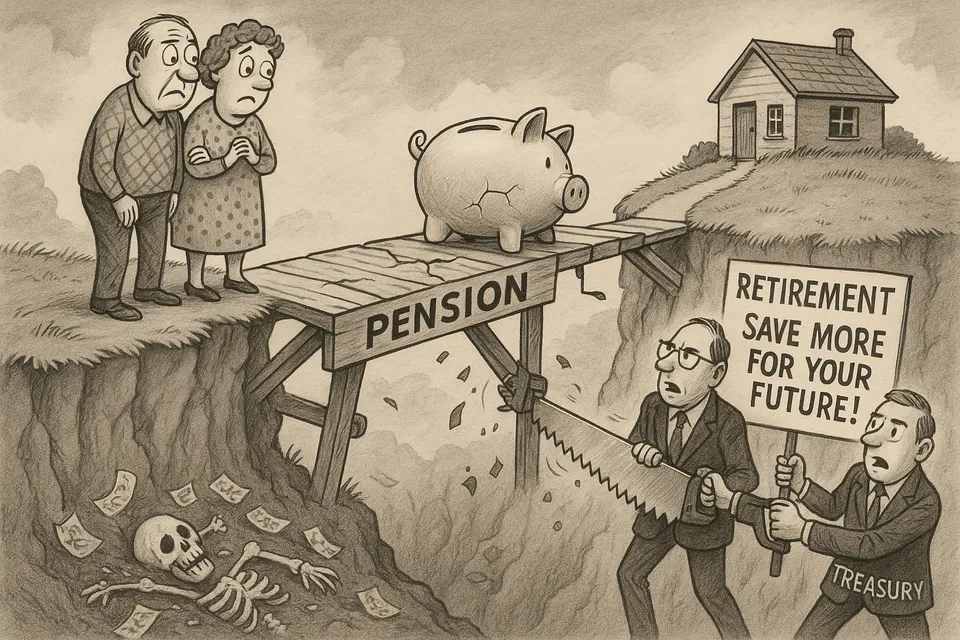

The Middle-Class Pension Trap: How Labour's Tax Raid Exposes Britain's Broken Social Contract

How Labour's Tax Policies Are Failing the Middle Class

Labour's tax policies are increasingly burdening the middle class, with new measures set to hit ordinary families hard. Despite promises to support working people, the reality is that many will face higher taxes and reduced benefits, all while the government fails to address the root causes of economic inequality.

Rachel Reeves has just torn up forty years of pension policy with a single Budget measure. From 2027, the average homeowner with a modest pension faces an £82,000 inheritance tax bill. In London, that figure doubles to £192,000. These aren’t mansion-dwelling millionaires - they’re ordinary people who saved exactly what the government told them to save for a “moderate” retirement.

The numbers expose the deception at the heart of British politics. For decades, both parties have insisted inheritance tax only affects “the wealthy” - a mere 4% of estates. By 2027, that figure will be 9.7%. Nearly one in ten families will now pay death duties, not because they’re rich, but because they followed official advice to save for retirement.

The Facts That Matter

An average-priced English home costs £290,395. The pension industry’s own calculations show you need £415,000 saved for a “moderate” standard of living in retirement - not luxury, just basic dignity. Combined, these assets total £705,395. After accounting for all allowances, the inheritance tax bill: £82,158.

This isn’t wealth. This is what responsible saving looks like in modern Britain. Yet the Treasury will now confiscate 40% of any pension that remains unspent at death, even if the saver dies before reaching pension age at 55. A working parent who dies at 50, having dutifully saved into their pension for decades, will see their family taxed on money they never had the legal right to access.

The Treasury expects to raise £1.5 billion annually from this change by 2029-30. That’s £1.5 billion taken from families who believed they were building security, not creating tax liabilities.

The Systematic Betrayal

This represents something deeper than a tax grab. It’s the systematic dismantling of every promise made to the prudent middle class. Save for retirement, they said. Use tax-efficient pensions, they advised. Build security for your family, they encouraged. Now those who listened face confiscation.

The particularly cruel detail buried in the policy: unmarried couples receive no spousal exemptions. A cohabiting couple with children, where one partner dies young, faces the full 40% levy with no protections. The grieving family with an average London home could face a £192,254 tax bill at the worst possible moment. The state that failed to protect their financial security in life will strip it away in death.

Meanwhile, reports suggest Reeves is considering further restrictions - a lifetime cap on gift-giving. Every escape route from this trap is being systematically closed.

The Pattern of Decline

This is how institutional decline manifests: not through dramatic collapse but through the quiet breaking of social contracts. The pension system was built on an implicit promise - save now, benefit later, pass on what remains. That promise sustained British capitalism for generations, encouraging thrift and self-reliance.

Labour isn’t just changing tax rates. They’re retroactively rewriting the rules for money already saved under different assumptions. People who made thirty-year financial plans based on government incentives are discovering those incentives were lies.

The Treasury’s defense is revealing: they claim to be stopping pensions being used “as a vehicle to transfer wealth.” But a £415,000 pension isn’t wealth - it’s the minimum needed for basic retirement security. The genuinely wealthy don’t rely on pensions for estate planning. They have trusts, offshore structures, and tax advisors. This policy hits those wealthy enough to save but not wealthy enough to escape.

What This Really Means

Britain has become a country where following official advice leads to punishment. Save too little, and you’re a burden on the state. Save the recommended amount, and you’re treated as rich enough to fleece. The message is clear: there is no correct amount to save, no path to security that won’t be retrospectively penalized when the Treasury needs revenue.

The 9.7% of estates that will pay inheritance tax aren’t the landed gentry or tech billionaires. They’re teachers who bought houses in the 1990s, engineers who maximized their pension contributions, small business owners who sold up and retired. They’re the people who did everything right according to the rules of their era, only to discover the rules have changed and the referee has fled.

This is managed decline in action: the orderly extraction of middle-class wealth to fund a state that can no longer sustain itself through growth. The UK has shifted from encouraging wealth creation to harvesting wealth already created, consuming the seed corn of its own prosperity.

The Bigger Picture

When a government taxes pensions people couldn’t legally access before death, it reveals the depth of fiscal desperation. When it retroactively changes the rules on lifetime savings, it destroys the social trust on which functioning economies depend. When it targets the moderately comfortable rather than the genuinely wealthy, it exposes who really runs the system and who merely pays for it.

The average family facing an £82,000 tax bill won’t hire expensive lawyers or establish Guernsey trusts. They’ll simply pay, watching decades of careful saving evaporate into Treasury coffers. Their children will learn the lesson: in modern Britain, prudence is punished and promises are meaningless.

This isn’t just bad policy. It’s the systematic destruction of the behavioral incentives that once made Britain prosperous. When saving for retirement becomes a tax trap, when home ownership creates liabilities instead of security, when following government advice leads to confiscation, the social contract hasn’t just broken - it’s been reversed.

The decline continues, one broken promise at a time.

Commentary based on Reeves’s inheritance tax raid to cost average homeowner £82,000 by Mattie Brignal on The Telegraph.