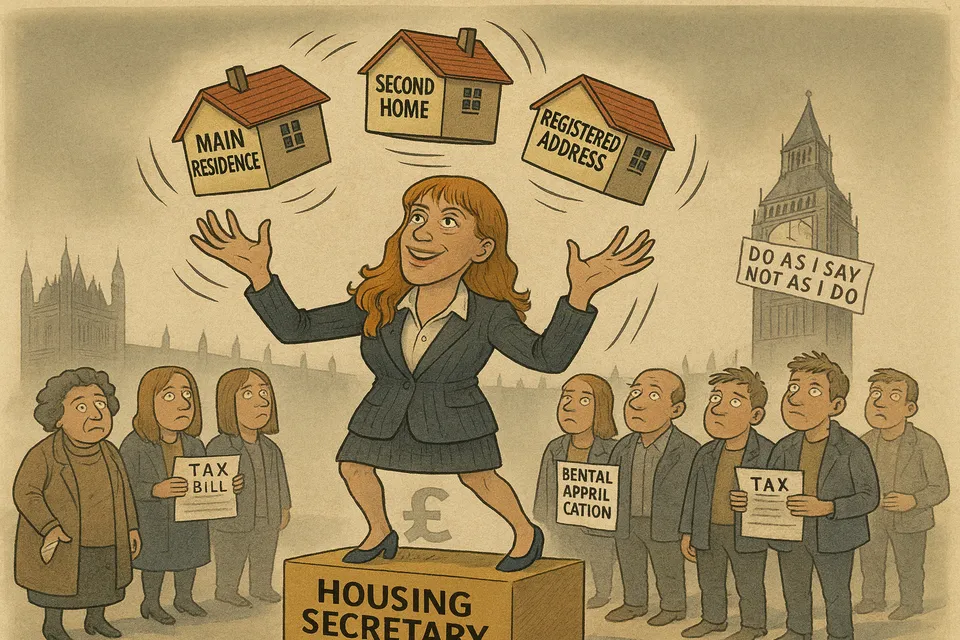

The Deputy Prime Minister's Three-Home Shell Game: A Masterclass in Legal Tax Avoidance

Angela Rayner's £40,000 Stamp Duty Dodge

Angela Rayner, the Deputy Prime Minister and Housing Secretary responsible for both council tax and election law, has orchestrated a property arrangement that saved her £40,000 in stamp duty while simultaneously ensuring taxpayers foot her London council tax bill.

The mechanics are simple: declare different properties as your “main home” to different authorities depending on which designation saves you the most money. Entirely legal. Entirely calculated. Entirely at odds with a government that raised stamp duty surcharges on second homes just months ago to “target the wealthy.”

The Facts

The Property Portfolio:

- Constituency home in Ashton-under-Lyne (no longer on the deeds)

- £800,000 flat in Hove (purchased May 2025)

- Grace-and-favour flat in Admiralty House, London

The Tax Choreography:

- Removed name from Manchester property deeds weeks before Hove purchase

- Declared Hove as main residence to HMRC: saved £40,000 in stamp duty

- Declared Manchester as main residence to Tameside council: avoids council tax on London flat

- Declared Hove as second home to Brighton council: pays second home premium there

- Registered to vote at all three addresses

The Cost to Taxpayers:

- £4,000+ annually in council tax for her Admiralty House flat (double the standard rate due to Labour’s own second homes premium)

Pattern Recognition: The Political Class Playbook

This isn’t about one politician gaming the system. It’s about a political class that has perfected the art of legal tax minimization while simultaneously raising taxes on everyone else.

Consider the timeline:

- October 2024: Rachel Reeves raises stamp duty surcharge on second homes

- May 2025: Deputy PM uses property shuffling to avoid that same surcharge

- 2025: Labour implements council tax premium on second homes

- 2025: Same Deputy PM ensures taxpayers pay that premium on her behalf

The same government that tells citizens to pay more has cabinet members structuring their affairs to pay less.

The Institutional Failure

Here’s what this reveals about UK governance:

1. Rules for Thee, Not for Me The Housing Secretary responsible for council tax policy has arranged her affairs to avoid paying it. The minister overseeing election law is registered to vote in three places - something ordinary citizens would find questionable at best.

2. The Complexity Shield Multiple residences, varying registrations, deed modifications - the arrangements are so convoluted that accountability becomes impossible. When challenged, the response is always “entirely legal” and “followed all advice.” Legal complexity becomes a shield against moral scrutiny.

3. The Gaslighting Rayner’s spokesman insists Ashton-under-Lyne is her “primary residence” for council tax purposes. Yet neighbors report rarely seeing her. She told The Times her children “come to visit her” in London because “it’s the only way he can get to see me.” The primary residence is wherever saves the most tax at any given moment.

What This Really Means

For Citizens: You’re paying twice - once through your own rising stamp duty and council tax bills, and again to cover the tax bills of politicians who’ve structured their affairs to avoid those same charges.

For Democracy: When the people making tax law are simultaneously engineering ways around it, the social contract breaks down. Why should citizens comply with the spirit of tax law when those who write it only comply with the letter?

For Trust: Every revelation like this further erodes the already threadbare trust between governors and governed. The defense is always technical compliance, never ethical leadership.

The Reality Check

This isn’t corruption in the traditional sense - no brown envelopes, no bribes. It’s something more insidious: a political class so disconnected from ordinary life that it sees nothing wrong with elaborate tax avoidance schemes while raising taxes on everyone else.

The Deputy Prime Minister will keep her three homes, her three voter registrations, and her £40,000 stamp duty saving. Taxpayers will keep paying her council tax. The spokesman will keep insisting everything is “entirely proper.”

And the gap between what politicians say about fairness and how they actually behave will grow ever wider.

The Bottom Line: When the minister responsible for housing policy has three homes and pays less tax than someone with two, when the official overseeing election law is registered to vote in three places, and when taxpayers fund the council tax of millionaire politicians - you’re not looking at a functioning democracy. You’re looking at institutional decline dressed up in legal technicalities.

This exemplifies why The Decliner exists: to document how the UK’s political class operates versus how it claims to operate. The decline isn’t just in outcomes - it’s in the very character of governance itself.

Commentary based on Angela Rayner dodges £40,000 stamp duty by Robert Mendick, Amy Gibbons on The Telegraph.