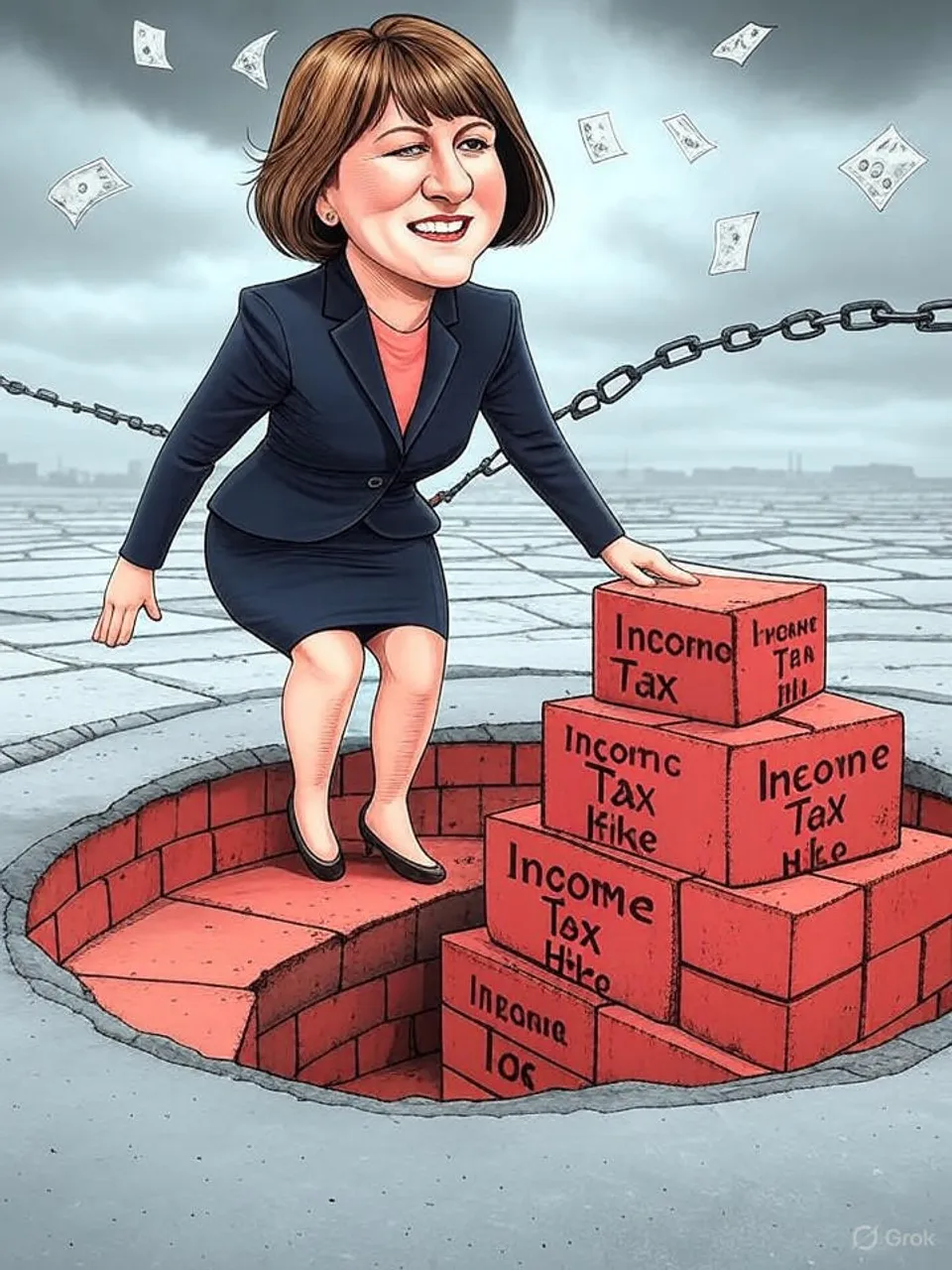

Reeves Weighs Income Tax Hike Amid £22 Billion Void

Breaking a 50-year pledge to plug gaps left by chronic underinvestment

Rachel Reeves eyes a basic rate income tax rise, shattering Labour's no-tax vow amid a £22 billion shortfall. This reveals persistent fiscal mismanagement across parties, forcing painful choices that burden households without restoring public services.

Commentary Based On

The Guardian

Prospect of breaking 50-year income tax taboo shows scale of Reeves’s challenge

Reeves Weighs Income Tax Hike Amid £22 Billion Void

Rachel Reeves contemplates raising the basic income tax rate for the first time since 1975, directly contradicting Labour’s election pledge against increases in income tax, national insurance, or VAT. This move addresses a £22 billion fiscal shortfall inherited from the previous government, yet it exposes deeper structural deficits accumulated over decades. The chancellor’s early signaling underscores the immediate pressure on public finances.

In 1975, Labour’s Denis Healey lifted the basic rate to combat inflation and unemployment triggered by oil shocks. Today’s context differs: stagnant growth, high debt, and post-pandemic spending have left a £22 billion gap in departmental budgets for the current year. Reeves now faces a similar bind, where avoiding tax rises risks deeper cuts to services already strained.

Polling data reveals the political cost. YouGov finds 65% of Britons oppose a basic rate increase, with only 22% in support. Yet Persuasion UK’s research indicates voters might tolerate the breach if it funds tangible gains in the NHS, cost of living, or child poverty reduction—outcomes that previous administrations promised but failed to deliver.

The revenue potential drives the consideration. The Institute for Fiscal Studies estimates a 1 percentage point rise across all income tax rates would generate nearly £11 billion annually by 2029-30, mostly from the basic rate affecting 80% of taxpayers. This dwarfs yields from alternatives like tweaking thresholds or allowances, which produce smaller sums.

Alternatives carry their own risks. Raising VAT, though less visible, could stoke inflation, a concern for the Treasury amid recent rate cuts. Employee national insurance remains off-limits politically, following last year’s employer NIC hike that critics labeled a jobs tax, especially with unemployment edging upward.

Labour’s 2024 manifesto framed tax stability as a cornerstone, pledging no rises to signal fiscal responsibility after 14 years of Conservative rule. That promise now crumbles under the weight of unfunded commitments and economic inheritance. The gap highlights how incoming governments inherit imbalances that force reversals, regardless of party.

This pattern recurs across administrations. Conservatives in 2010 pledged no VAT rise but increased it to 20% by 2011; Labour under Brown raised the basic rate to 22% in 2009 before the crash. Each shift reveals chronic underestimation of spending needs against revenue, with deficits ballooning from 2% of GDP in the early 2000s to over 5% today.

Public anticipation builds the tension. Last week’s YouGov poll showed 42% of voters expect an income tax rise, reflecting eroded trust in fiscal pledges. Desertion among 2024 Labour voters stems primarily from perceived broken promises, per summer research, amplifying the stakes for Reeves.

The chancellor’s strategy bets on a single, visible tax measure over scattered adjustments. Proponents argue it avoids the “smorgasbord” of unpopular tweaks, like freezing allowances or cutting green levies. But failure to link the rise to observable improvements—such as shorter NHS waits or lower energy bills—could deepen unpopularity beyond current lows.

Institutional inertia compounds the challenge. The Office for Budget Responsibility’s rules mandate balancing the current budget, yet borrowing for investment remains constrained. This framework, introduced post-2010, limits maneuverability, forcing tax or cut decisions that previous chancellors deferred through quantitative easing or off-balance-sheet spending.

Ordinary citizens bear the immediate impact. A 1 point basic rate hike deducts £200-300 yearly from median earners, hitting those already squeezed by 25% real wage stagnation since 2008. Meanwhile, public services decay: NHS waiting lists exceed 7.6 million, and child poverty affects 4.3 million, metrics unchanged or worsened across governments.

The episode lays bare fiscal governance’s core flaw. Parties campaign on tax freezes while governing amid structural deficits fueled by low productivity—1.5% annual growth since 2008, half the OECD average—and demographic pressures. Accountability evaporates as chancellors blame predecessors, perpetuating a cycle where promises yield to reality.

Reeves’s dilemma cements Britain’s economic trajectory: a mature economy trapped in low-growth equilibrium, where tax rises fund maintenance rather than progress. This 50-year taboo’s end signals not mere inheritance but systemic incapacity to reform. Citizens face higher burdens for services that continue to erode, underscoring the nation’s deepening fiscal sclerosis.

Commentary based on Prospect of breaking 50-year income tax taboo shows scale of Reeves’s challenge by Eleni Courea on The Guardian.