The VAT Raid's Real Casualties: How Labour's Education Tax Destroyed Working Class Aspiration While Handing Millions to Eton

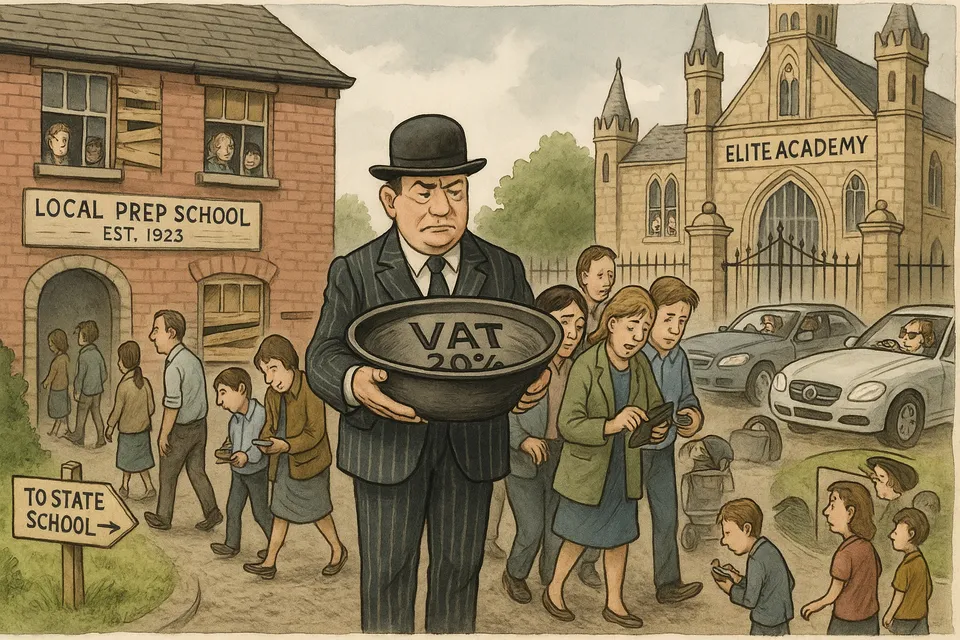

Analysis of Labour's VAT on private schools reveals a policy that has backfired spectacularly, harming the very families it claimed to help while enriching elite institutions.

Six months after Labour introduced VAT on private school fees, the evidence reveals a policy that has achieved the exact opposite of its stated aims. While politicians promised to fund 6,500 new state teachers by taxing elite institutions, the reality shows working class families priced out of education, state schools overwhelmed by displaced pupils, and Britain's most expensive schools claiming millions in VAT rebates.

Commentary Based On

The Telegraph

Revealed: the full, devastating impact of Labour’s VAT raid on private schools

Labour’s Treasury forecast that 3,000 pupils would leave private education. The actual figure already exceeds 16,000 from mainstream schools alone - a miscalculation of over 500%. This isn’t a minor forecasting error; it’s evidence of policy-making divorced from reality.

The financial projections are equally detached from evidence. Treasury models assumed schools would raise fees by 10%. Actual increases have reached 17%, accelerating the exodus of middle-income families while barely affecting those wealthy enough to absorb any cost.

Most revealing is where the casualties have fallen. St Joseph’s Preparatory School in Stoke-on-Trent, charging £10,245 annually, closed on December 31st. Its headmistress described parents as “working class families” who took extra hospital shifts to afford their children’s education. Meanwhile, Eton College stands to reclaim £4.8 million in historic VAT payments - a direct transfer from the Treasury to Britain’s most elite institution.

The promised 6,500 “new teachers in key subjects” has already been watered down. They’re no longer necessarily “new,” won’t necessarily teach “key subjects,” and the pledge now excludes primary schools entirely. More significantly, the Prime Minister has revealed the funds aren’t even ring-fenced for education - they’ll support housebuilding targets instead.

Destroying Aspiration While Rewarding Privilege

This policy exemplifies modern British governance: ideologically driven, poorly executed, and achieving the opposite of its stated intentions. The pattern is grimly familiar - target the aspirational middle while leaving the truly privileged untouched.

Consider the mechanics of destruction. Families earning £50,000-70,000 who sacrificed holidays and new cars to invest £10,000 annually in their child’s education have been forced out. These aren’t the wealthy - they’re nurses, small business owners, and middle managers who believed education could transform their children’s prospects. That pathway has been severed.

The state sector, already creaking under pressure, must now absorb thousands of additional pupils. Each child moving from private to state education costs the government approximately £8,000 annually in funding while losing the VAT revenue their fees would have generated. If the 16,000 pupils who’ve already left were paying average fees, that’s a £70 million revenue loss before counting state funding costs.

But the truly perverse outcome is the windfall for elite schools. By changing their VAT status, schools can now reclaim a decade of historic VAT on capital projects. Eton’s swimming pools and concert halls, built with VAT-inclusive costs, now generate multi-million pound rebates from the Treasury. The policy designed to make private education “pay its fair share” has become a subsidy for the schools that need it least.

Institutional Capture and Political Theatre

This isn’t mere incompetence - it’s symptomatic of deeper institutional decay. The Treasury’s wildly inaccurate projections suggest either staggering ignorance of basic economics or deliberate misrepresentation to justify a predetermined policy. Neither explanation inspires confidence.

The rapid abandonment of the education spending pledge reveals the truth: this was never about improving state schools. It was political theatre, designed to signal “fairness” while actually increasing inequality. The Parliamentary public accounts committee’s assessment that the government “lacks a coherent plan” for recruiting the promised teachers merely confirms what the policy’s structure already revealed.

Most tellingly, schools that survived two world wars, the Great Depression, and decades of economic turbulence have been destroyed in six months by a tax change. Queen Margaret’s School in York, founded in 1901, would have celebrated its 125th anniversary next year. Instead, it closed forever on July 5th, taking with it jobs, community connections, and educational diversity that can never be rebuilt.

What This Means for Britain’s Future

The VAT raid represents British decline in microcosm: poorly conceived policies that destroy functioning institutions while failing to achieve their stated goals. It reveals a political class that prefers gesture politics to genuine reform, and a civil service incapable of accurate impact assessment.

For thousands of families, the damage is immediate and irreversible. Children have been uprooted mid-education, forced into overcrowded state schools that gained no additional resources to handle the influx. Communities have lost major employers - Queen Margaret’s was the largest employer in its Yorkshire village. The aspirational route that allowed working families to invest in education has been closed.

Meanwhile, elite education remains untouched. Eton’s parents won’t notice a 20% increase on £50,000 annual fees, and the school’s VAT rebate provides a comfortable cushion. The genuinely wealthy continue their parallel education system while the drawbridge is pulled up on everyone else.

The Broader Implications

This issue perfectly encapsulates modern British governance. A policy is announced with grand promises about fairness and funding. Implementation reveals massive miscalculations and unintended consequences. The stated beneficiaries - state school pupils - receive nothing. The supposed targets - elite schools - receive windfalls. The actual casualties - aspirational families and smaller schools - are dismissed as acceptable collateral damage.

The revelation that funds will support housebuilding rather than education strips away the last pretense. This was never about improving education; it was about finding revenue sources that wouldn’t provoke wealthy donors or powerful interests. That it destroyed educational diversity and opportunity in the process is, apparently, irrelevant.

Britain’s tax system now actively punishes aspiration while subsidizing privilege. Schools that educated generations, that provided scholarships for Ukrainian refugees and music lessons for ambitious children, have been sacrificed for a policy that will likely raise far less than projected while causing far more damage than admitted.

This is what institutional decline looks like: not dramatic collapse but the steady destruction of what works, justified by promises that what replaces it will be better, even as the evidence mounts that it’s demonstrably worse. The private school VAT raid isn’t just bad policy - it’s a perfect example of how modern Britain governs itself into decline.

Commentary based on Revealed: the full, devastating impact of Labour’s VAT raid on private schools by Pieter Snepvangers on The Telegraph.