• via BBC News

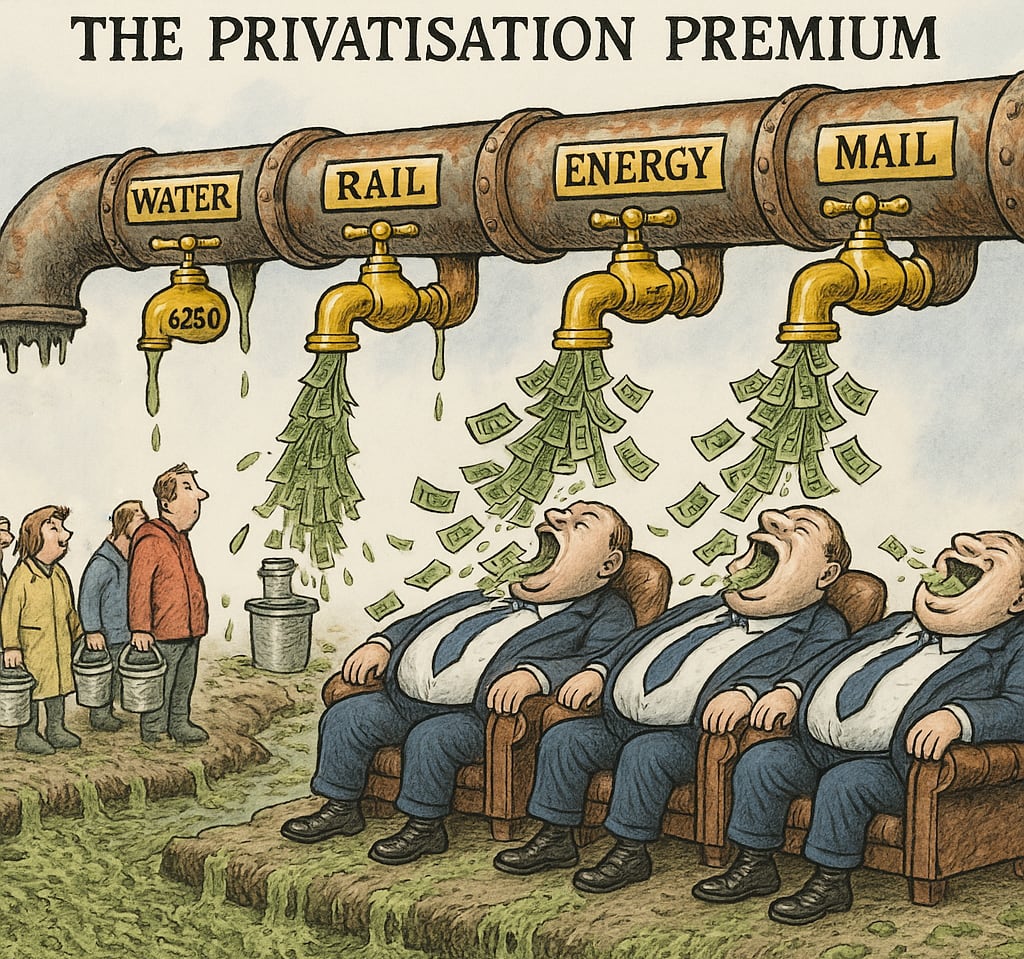

When Failure Pays: The Water Industry's Reward System

How privatized water companies in England profit from underinvestment and rising bills

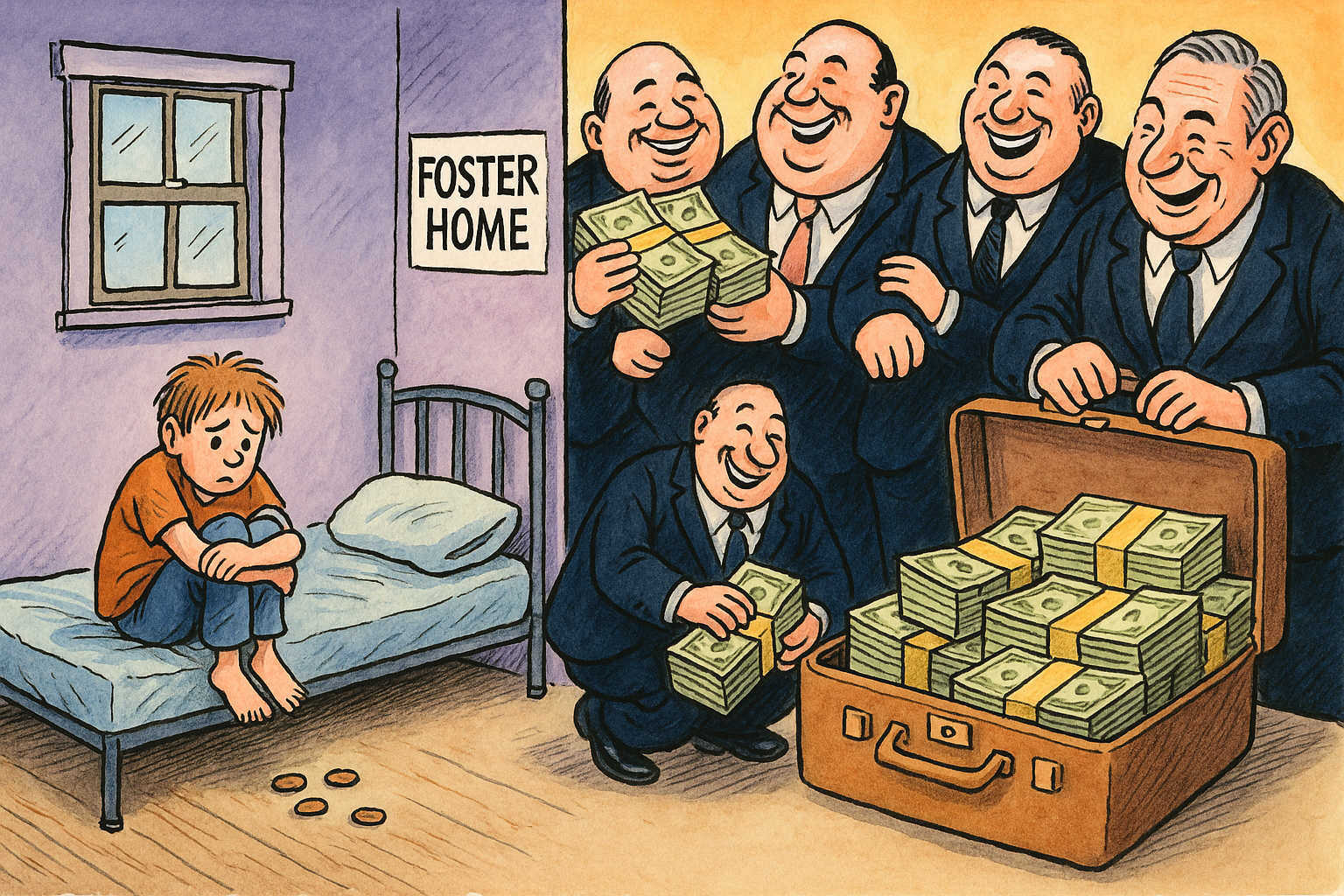

Five English water companies have successfully argued for higher bills to cover infrastructure failures they were supposed to maintain. The Competition and Markets Authority approved an additional £556 million in charges, on top of already planned 36% increases over five years. This comes as serious pollution incidents by water firms jumped 60% in a single year, highlighting a troubling pattern of privatized monopolies profiting from public goods while failing to deliver essential services.