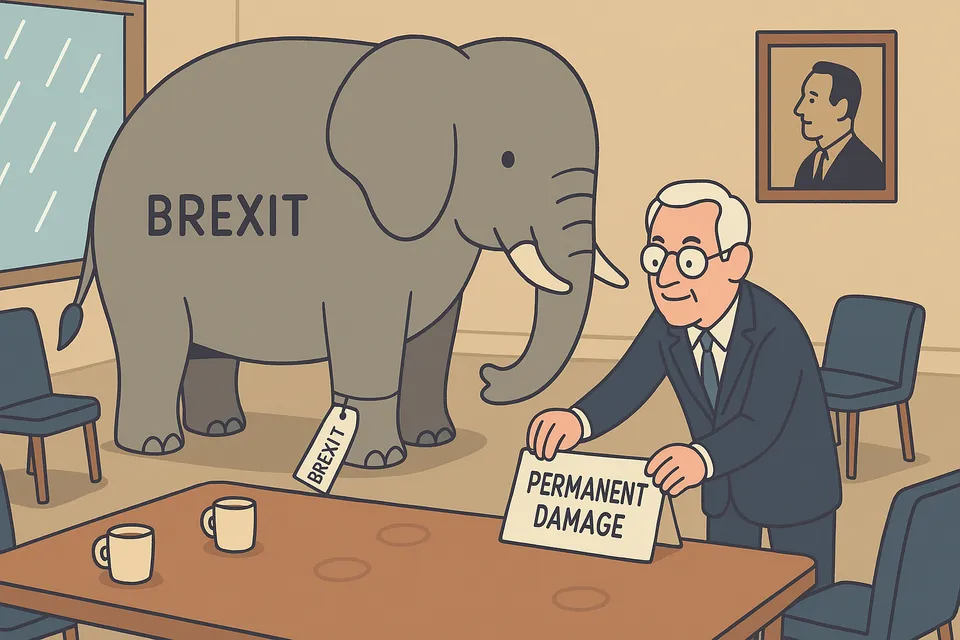

The Bank of England Finally States the Obvious: Brexit Is Permanent Economic Damage

Brexit's economic costs were known but unspoken for years.

In a rare moment of candour, Bank of England Governor Andrew Bailey has acknowledged that Brexit will inflict permanent damage on the UK's economic growth. This admission highlights years of institutional silence and the harsh realities facing Britain's economy post-Brexit.

Commentary Based On

Sky News

Brexit impact on UK economy 'negative for foreseeable future', Bank of England chief says

For nearly a decade, Andrew Bailey performed the careful dance of the politically neutered technocrat. As Bank of England Governor, he maintained studious silence on Brexit’s economic impact, hiding behind the respectable fig leaf that “it was a decision by the people” he must simply “implement.”

That era ended Saturday in Washington DC, when Bailey acknowledged what the data has screamed for years: Brexit will damage UK economic growth “for the foreseeable future.”

The admission matters not because it reveals anything new—economists have documented Brexit’s costs since 2016—but because it exposes how Britain’s institutional leadership spent a decade prioritizing political comfort over economic reality.

What Bailey Actually Said

The Governor didn’t hedge. Asked directly about Brexit’s growth impact, he stated: “As a public official, I have to answer that question. And the answer is that for the foreseeable future it is negative.”

He linked Brexit to a collapse in Britain’s potential growth rate from 2.5% to 1.5% over 15 years, alongside lower productivity, an ageing population, and trade restrictions. He offered vague hope that “trade adjusts” and economies “rebalance” over time, then pivoted to placing Britain’s economic chips on AI as salvation.

This is the Governor of the Bank of England admitting that a fundamental policy choice has permanently reduced what Britain can achieve economically, whilst suggesting technology might eventually paper over the damage.

The Facts Behind the Admission

Britain’s growth trajectory collapsed after 2016. The potential growth rate halving from 2.5% to 1.5% represents not a temporary disruption but a fundamental downgrade in national economic capacity.

August 2024 GDP grew just 0.1% month-on-month. July saw a 0.1% contraction. The three months to August managed 0.3% growth. These aren’t figures suggesting an economy finding its feet post-Brexit—they’re the numbers of an economy permanently operating below its previous capacity.

The International Monetary Fund now forecasts UK inflation will reach the highest in the G7 in 2025 and 2026. Britain faces the worst of both worlds: anemic growth paired with elevated inflation.

Trade restrictions—the polite term for the barriers Britain erected against its largest trading partner—contributed directly to lower productivity. Productivity growth, the essential ingredient of rising living standards, stagnated.

Bailey’s suggestion that AI might rescue productivity ignores that Britain’s European competitors will also deploy AI, from a higher baseline and without Brexit’s self-imposed trade barriers. You don’t catch up by hoping everyone else stands still.

Nine Years of Institutional Silence

Bailey’s carefully maintained neutrality exemplifies how Britain’s institutional leadership failed during the Brexit process. The Bank of England possessed clear evidence of Brexit’s economic costs from 2016 onward. It said nothing definitive.

The Treasury knew. The Office for Budget Responsibility knew. Every serious economic institution knew. They produced reports, footnoted warnings, and academic papers. What they didn’t do was speak plainly to the public about what was coming.

This wasn’t neutrality—it was institutional cowardice dressed as propriety. Public officials convinced themselves that respecting “the will of the people” required hiding professional analysis of that decision’s consequences.

The result: Britain sleepwalked into permanent economic downgrade whilst the people paid to understand economics maintained polite silence, fearful of appearing “political.”

The Pattern of Managed Decline

Bailey’s admission fits a familiar British pattern: make a catastrophic decision, maintain it regardless of evidence, admit the damage only when it’s irreversible, then suggest something else might fix it.

Brexit delivered exactly what economic analysis predicted: reduced trade, lower investment, decreased productivity, diminished growth. The promises made in 2016—easiest trade deals in history, economic boom, £350m weekly for the NHS—proved false. The warnings dismissed as “Project Fear” proved accurate.

Britain’s response has been to insist everything is fine whilst GDP figures, trade data, and business investment numbers document the decline. Now the Bank of England Governor admits Brexit means lower growth “for the foreseeable future”—after the decision is beyond reversal.

This is how Britain manages decline: deny reality until denial becomes impossible, admit the damage only when it’s permanent, propose hopeful solutions that don’t address the underlying problem.

What “Foreseeable Future” Actually Means

Bailey’s phrase “foreseeable future” deserves examination. It’s the language of permanent damage softened by temporal vagueness.

Economies don’t “adjust” away from systematic trade barriers with their largest market. Trade doesn’t “rebalance” when you’ve deliberately made commerce more difficult. Productivity doesn’t recover when you’ve reduced your access to workers, markets, and investment.

The “foreseeable future” means the remainder of most working people’s careers. It means the next generation inheriting an economy permanently smaller than it would have been. It means accepting lower growth as the new normal because reversing Brexit remains politically impossible.

Bailey knows this. His suggestion that partial rebalancing might occur “over the longer term” is technocrat-speak for “this is permanent but I cannot say so.”

The AI Distraction

Bailey’s pivot to AI as Britain’s economic salvation exemplifies magical thinking. Yes, AI may boost productivity eventually. Yes, general-purpose technologies can drive growth. But AI won’t eliminate the costs of trade barriers, won’t reverse demographic ageing, and won’t restore Britain’s potential growth rate to pre-Brexit levels.

More importantly, Britain’s competitors—including EU nations operating without Brexit’s handicaps—will also deploy AI. Technology doesn’t provide comparative advantage when everyone has access to it. Britain will implement AI from a position of relative weakness, having already reduced its growth potential through policy choice.

Suggesting AI might fix Brexit’s damage is like suggesting a new engine might help a car with slashed tyres. It misunderstands which problem requires solving.

The Chancellor’s Impossible Position

Rachel Reeves faces next month’s budget attempting to deliver growth from an economy Bailey has just confirmed operates under permanent Brexit constraints. Official figures show muted August growth following July’s contraction. The IMF forecasts Britain leading the G7 in inflation.

This is the economic inheritance of Brexit: lower growth capacity, persistent inflation, constrained policy options, and a Bank of England Governor finally admitting what everyone knew but institutions wouldn’t say.

Reeves can adjust tax rates and spending priorities. She cannot adjust away Brexit’s costs. The economy’s potential has been permanently reduced. No amount of budgetary cleverness changes that reality.

The Cost of Institutional Cowardice

Britain’s decline accelerated not just because of Brexit but because institutions that knew better stayed silent. The Bank of England, Treasury, and civil service possessed clear analysis of Brexit’s costs. They produced careful reports whilst public debate raged based on fantasy economics and outright lies.

Had Bailey and his predecessors spoken plainly in 2016—“this will permanently reduce UK growth”—would it have changed the outcome? Perhaps not. But institutional silence gave permission for politicians to promise what economics made impossible.

Now Bailey states the obvious: Brexit damages growth for the foreseeable future. The admission comes nine years late, after Britain has locked itself into permanent economic underperformance.

This is how decline proceeds: catastrophic decisions, institutional silence, belated admission of damage, hopeful suggestions that something else might fix it. By the time truth emerges, reversal has become impossible.

Britain chose Brexit. Britain’s institutions chose silence. The economy documents the cost in reduced growth, lower productivity, and diminished potential.

And the Governor of the Bank of England finally admits what the data showed all along.

Commentary based on Brexit impact on UK economy 'negative for foreseeable future', Bank of England chief says at Sky News.