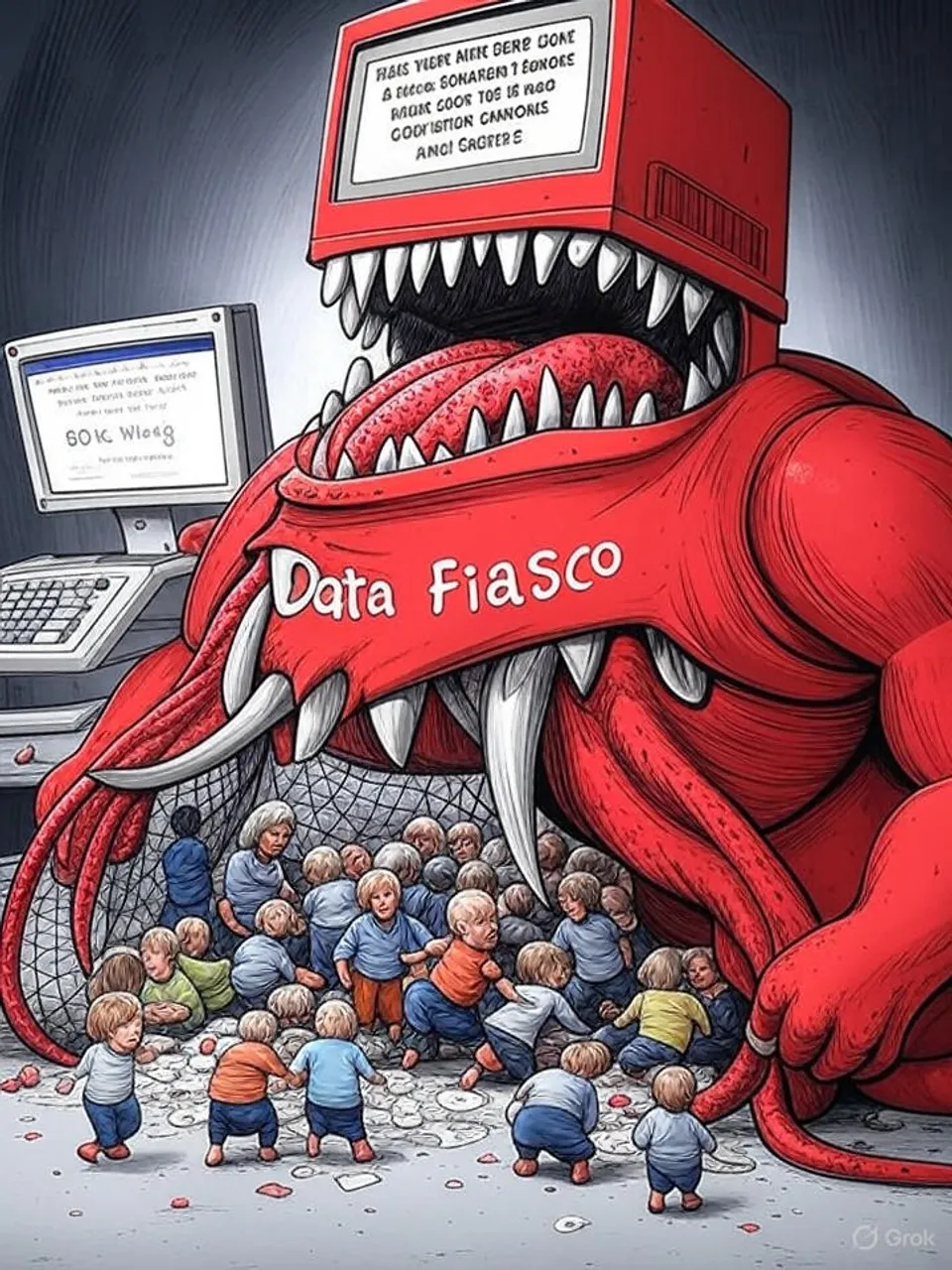

HMRC Traps 15,000 Families in Child Benefit Data Fiasco

63% false positives from flawed Home Office travel records

HMRC's anti-fraud crackdown wrongly suspended benefits for 15,000 legitimate parents using unreliable border data. The debacle highlights systemic flaws in welfare enforcement, punishing innocents while real fraud persists.

Commentary Based On

the Guardian

Labour admits 60% of parents wrongly targeted in HMRC child benefit fraud crackdown

HMRC suspended child benefits for 23,500 parents using Home Office travel records. Government data now confirms 15,000 of them—63 percent—as legitimate UK residents. The crackdown, sold as precise anti-fraud, delivered mass false positives.

Flaws stemmed from unconfirmed passenger bookings and patchy border checks. Parents lost payments after cancelled trips, illnesses, or flights they never took. One childminder in Yorkshire had never left the country, passport-free, yet faced suspension.

A pilot last autumn included PAYE wage checks. The national rollout ditched them, expanding errors nationwide. HMRC paused new inquiries by November, after outcry.

Initial disclosures hid the scale. HMRC admitted only 3,673 valid claims by late October. The true figure, revealed in a parliamentary answer, quadrupled that total.

Opposition MP Andrew Snowden called it “deeply troubling.” Only 4.3 percent of targets proved fraudulent, with 8,800 cases still open. Families reliant on the £25 weekly payment endured weeks without funds for basics.

Experts at the Open Rights Group flag data protection breaches. Regulators like the Information Commissioner’s Office stayed silent, issuing no audits or notices. HMRC shifted proof burdens onto claimants.

The agency defends travel data as a tool hitting under 2 percent of recipients. It promises future refinements via PAYE. Self-employed and carers, however, fall outside those nets.

This episode exposes state machinery’s core weakness: overreliance on crude, unverified datasets. Border records, meant for security, fuel welfare enforcement with civilian-grade errors.

Real child benefit fraud drains £2-3 billion yearly across governments. Botched hunts like this waste admin resources and compound harm. Taxpayers fund the errors, from investigations to repayments.

Institutions repeat the cycle. Pilots identify risks, rollouts ignore them, scandals prompt pauses. No executives face demotion; systems reset for the next drive.

Families paid the price in stress and emptied accounts. One parent linked suspension to a child’s epileptic seizure at an airport gate. Ordinary lives disrupted by official incompetence.

Britain’s welfare enforcement now punishes compliance over evasion. HMRC’s fiasco reveals deeper rot: data silos collide without safeguards, eroding trust in every payout. Citizens bear the costs of unaccountable state power, as decline embeds in daily administration.

Commentary based on Labour admits 60% of parents wrongly targeted in HMRC child benefit fraud crackdown by Lisa O'Carroll on the Guardian.