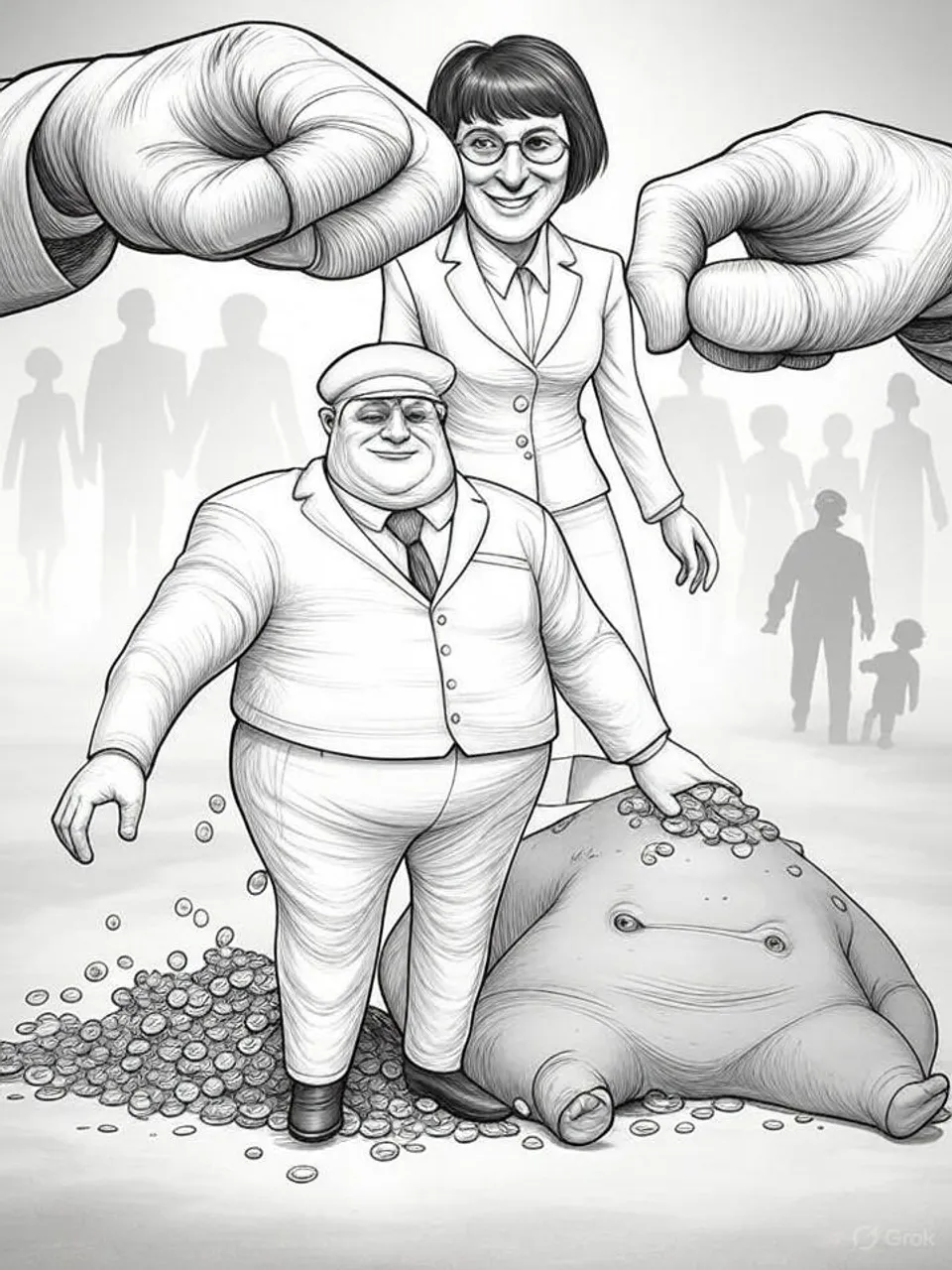

Middle-Class Squeeze Funds Expanding Welfare State

£3.4 Billion Welfare Boost Amid Tax Threshold Freezes

Labour's budget proposals redirect billions from workers' pockets to welfare expansions, perpetuating cross-party fiscal policies that stifle growth and drive emigration. This reveals systemic incentives favoring dependency over productivity.

Rachel Reeves signals further expansion of welfare spending, including £3.4 billion annually to relax the two-child benefit cap, while middle-income households face frozen tax thresholds that drag more earners into higher brackets. Official projections show this fiscal year alone pushing 1.2 million additional taxpayers into the 40% band since 2022. The gap widens between Labour’s growth rhetoric and policies that redistribute from workers to non-workers.

This approach stems from Labour’s need to consolidate its electoral base amid falling approval ratings. Polls indicate Starmer’s government trails rivals by double digits just months after taking office. Prioritizing public sector pay rises and benefit enhancements secures loyalty from state-dependent voters, even as overall economic output stagnates.

Key revenue measures target savers and consumers directly. A raid on salary sacrifice schemes could claw back £4 billion from pension contributions, redirecting funds that would otherwise grow tax-free before withdrawal. This discourages private investment at a time when UK pension assets lag behind OECD peers by 20% in real terms.

Smaller taxes yield even less efficiency. Scrapping customs exemptions on low-value imports raises just £500 million yearly but imposes new tariffs and handling fees on online shoppers. Retail data from 2024 shows such costs already inflate household expenses by 2-3% for imported goods, hitting lower-middle earners hardest.

Council tax reforms expose regional inequities. Funding cuts to self-sufficient councils force 10% annual hikes in some areas, as noted by Conservative leader James Cleverly. A property revaluation for top bands, paired with a new Treasury levy, effectively taxes land improvements and stalls housing transactions.

These moves repeat fiscal patterns across administrations. The 2010-2024 Conservative governments similarly froze thresholds, raising effective tax rates by 5 percentage points for median earners without offsetting growth. Labour’s welfare expansions build on unchecked benefit rises that doubled universal credit claims since 2010.

No party addresses the underlying productivity slump. UK GDP per hour worked trails the US by 30% and Germany by 15%, per 2024 ONS data. Policies favoring redistribution over incentives perpetuate this, as capital flight accelerates—emigration of high earners hit 257,000 in 2024, the highest since 1964.

Institutional inertia compounds the damage. Treasury forecasts admit a £22 billion “black hole” inherited from predecessors, yet new spending lacks structural reforms like welfare-to-work mandates. Officials face no repercussions for repeated forecast errors, with chancellors cycling through roles unscathed.

Ordinary citizens bear the load. A family on £50,000 dual income could see £2,000 more in taxes yearly from threshold freezes alone, per Institute for Fiscal Studies calculations. Meanwhile, benefit households gain from relaxed sanctions, widening the net fiscal transfer from 40% of GDP in welfare spending.

This budget entrenches a system where effort yields diminishing returns. Emigration talks among professionals reflect a breaking point, as productive workers seek jurisdictions with lower burdens. Britain’s decline manifests in this zero-sum game: workers penalized, growth forsaken, and state dependency normalized across political cycles.

Commentary based on This Budget will punish the workers and reward the shirkers by Telegraph View on The Telegraph.