The Stealth Tax Spiral: How Labour's Promises Collided With Reality

Rachel Reeves' Fiscal U-Turn and the Rise of Britain's Stealth Tax State

Britain's fiscal theatrics have reached a predictable crescendo. Rachel Reeves, having spent months insisting Labour would not raise taxes after their election victory, now finds herself eyeing the most regressive stealth tax available: freezing income tax thresholds to drag more workers into higher tax brackets.

Commentary Based On

The Guardian

Reeves expected to freeze income tax thresholds to raise funds after welfare U-turn

What they claim: Labour promised not to raise taxes on “working people” and insists there’s “no inevitability” about tax increases, with Treasury sources claiming “sentiment is really changing” about the UK economy.

What actually happened: Reeves is extending a stealth tax that will drag 500,000 more workers into higher tax brackets this year alone, raising £8bn annually by making teachers, nurses, and skilled workers pay higher rates without technically breaking Labour’s tax promises—a regressive accounting trick that hits middle-income earners while the wealthy remain largely untouched.

The arithmetic is brutally simple. Starmer’s welfare U-turns have blown a £3bn annual hole in the budget. Combined with the £1.25bn cost of partially reversing the winter fuel allowance cuts, and an expected downgrade in growth forecasts from the Office for Budget Responsibility, the Chancellor faces a funding gap that could reach £20bn. Her solution reveals everything wrong with how Britain now governs itself.

The Numbers Behind the Decline

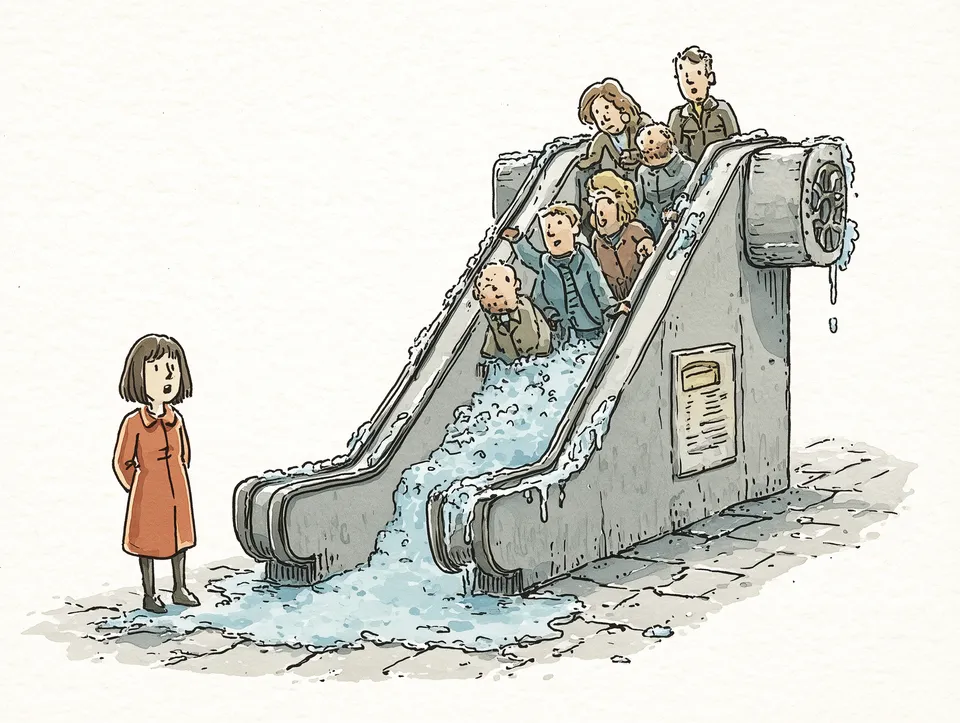

The threshold freeze, inherited from Jeremy Hunt’s Conservative government, demonstrates how policy failures transcend party lines. Already set to drag 500,000 more people into the higher rate tax bracket this year, bringing the total to 7 million, extending this freeze represents the path of least political resistance. It raises £8bn annually while allowing politicians to claim they haven’t technically broken their tax promises.

This is governance by accounting trick. While Labour pledged not to raise income tax rates, VAT, or National Insurance, they remain silent about allowing fiscal drag to do the work for them. As inflation erodes the value of fixed tax thresholds, more workers automatically slip into higher tax brackets without any parliamentary vote or public debate.

The Resolution Foundation calculates that extending the freeze for two years would generate enough revenue to cover Labour’s immediate funding gaps. But this misses the broader pattern: every government now governs through stealth measures because honest conversation about tax and spending has become impossible.

The Institutional Rot

Three elements of Britain’s governing dysfunction converge in this crisis. First, the electoral system rewards politicians for making unsustainable promises. Labour’s tax pledges were designed to win votes, not to fund a functioning state. The gap between campaign rhetoric and governing reality grows wider with each election cycle.

Second, the Office for Budget Responsibility’s forecasting process has created a perverse dynamic where politics revolves around gaming fiscal rules rather than delivering outcomes. Reeves has just £10bn of headroom against her borrowing limits, forcing constant market speculation about emergency tax rises. The system designed to impose discipline has instead created permanent instability.

Third, the welfare U-turn itself reveals how policy gets made in modern Britain. Faced with public pressure over disability benefit cuts, Starmer reversed course without any consideration of how to fund the reversal. This isn’t governing; it’s reactive damage control.

The Stealth Tax State

Paul Johnson from the Institute for Fiscal Studies captures the essential problem: “if you are looking for £10bn or £20bn it gets really quite difficult, if you’re not going to increase income tax or VAT.” Britain has painted itself into a fiscal corner where major tax rises are politically impossible, but adequate funding for public services remains mathematically necessary.

The threshold freeze offers a way out that satisfies no one but offends few enough to survive. It’s regressive, hitting middle-income workers hardest while leaving the wealthy largely untouched. It’s dishonest, allowing politicians to claim they’ve kept tax promises while raising the tax burden. And it’s inefficient, distorting incentives and creating cliff edges in the tax system.

Most fundamentally, it represents the institutionalization of deception. Rather than having an honest conversation about what government costs and who should pay for it, Britain’s political class has embraced elaborate mechanisms for raising money while pretending they aren’t doing so.

The Pattern Repeats

This crisis follows a familiar template that transcends party politics. Conservative governments froze tax thresholds while claiming to be the party of low taxes. Labour now prepares to extend those freezes while claiming to protect working people. Both operate within the same broken system that makes honest governance impossible.

The Treasury’s frustration with the OBR forecasting cycle points to a deeper truth: Britain’s fiscal framework has become a straitjacket that forces bad decisions. When economic forecasts can shift by more than the cost of major policy changes, and when political survival depends on maintaining artificial headroom against borrowing limits, rational long-term planning becomes impossible.

Even the proposed solutions reveal the institutional decay. The IMF suggests moving to just one OBR forecast per year to reduce market speculation, while the Bank of England Governor warns against “over-interpreting” the very forecasts that drive government policy. These are the suggestions of a system that knows it’s broken but can’t figure out how to fix itself.

The Real Cost

Behind the Westminster arithmetic lies a simple reality: Britain is becoming a higher-tax, lower-service state through the back door. The threshold freeze will hit teachers, nurses, police officers, and skilled tradespeople who find themselves dragged into tax brackets designed for the wealthy. Meanwhile, public services continue their managed decline, and infrastructure crumbles under decades of under-investment.

This isn’t just fiscal policy; it’s a symptom of democratic breakdown. When governments can’t have honest conversations about tax and spending, when promises are made knowing they can’t be kept, and when policy gets made through accounting tricks rather than democratic debate, the social contract erodes.

The threshold freeze will happen because it’s the least bad option in a system designed to produce bad options. It represents everything broken about how Britain now governs itself: dishonest, regressive, short-term, and designed more to avoid difficult conversations than to solve actual problems.

Twenty years ago, such fiscal gymnastics would have sparked genuine political debate about priorities and trade-offs. Today, they’re simply accepted as the way the system works. That acceptance is perhaps the clearest measure of how far Britain’s institutions have declined.

Commentary based on Reeves expected to freeze income tax thresholds to raise funds after welfare U-turn by Heather Stewart on The Guardian.