Three Pence Per Mile Erodes the EV Incentive

Government eyes 2028 levy amid £25 billion fuel duty shortfall

A proposed pay-per-mile tax on electric vehicles exposes policy contradictions, as fiscal pressures undermine the UK's green transition and burden drivers with new costs. Industry warnings highlight risks to adoption targets amid infrastructure gaps.

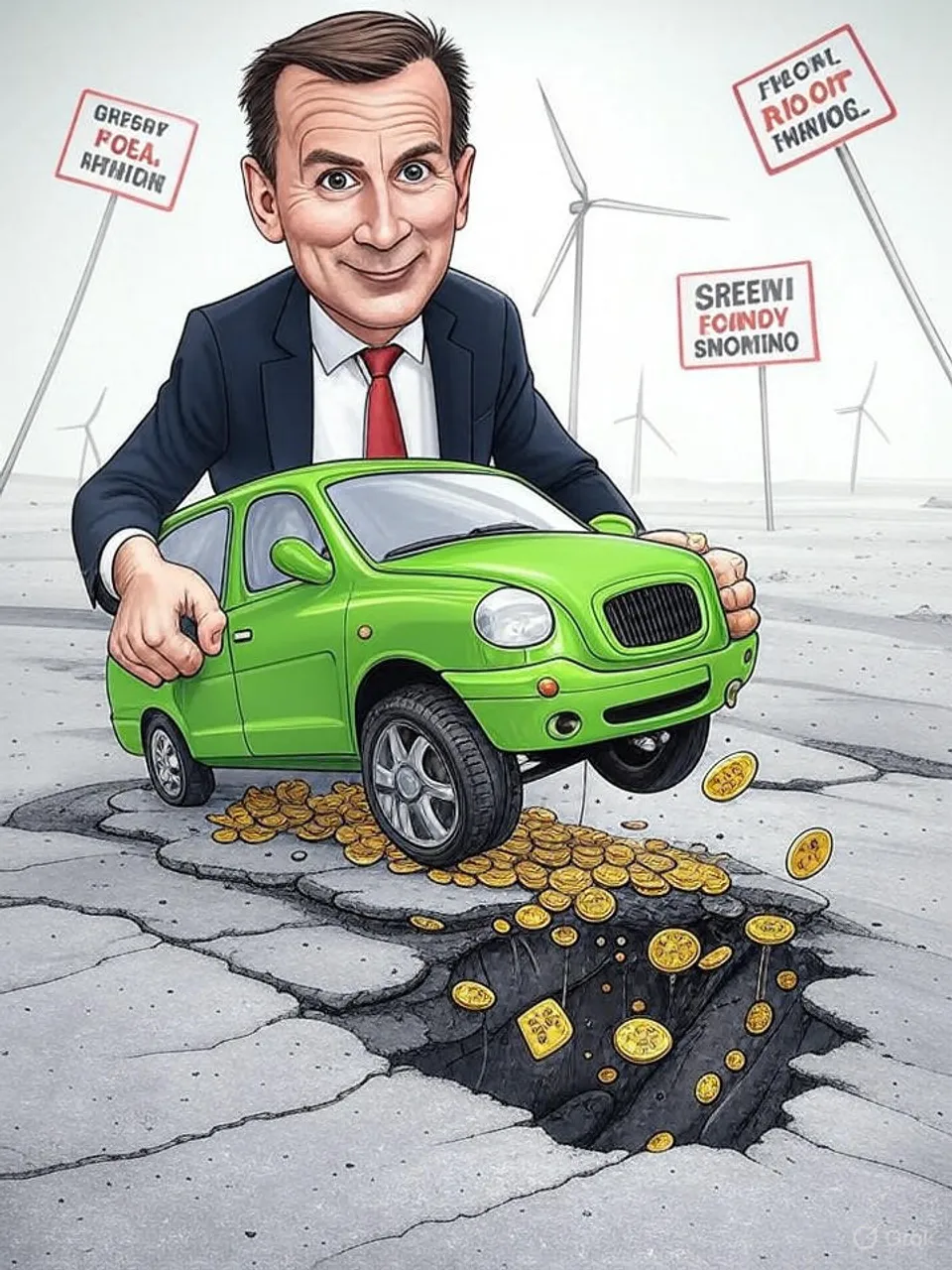

Electric vehicles promised a cleaner future, yet the government now eyes a 3p-per-mile tax on them starting in 2028. This levy, layered atop existing road taxes, would add £12 to a London-to-Edinburgh trip for EV drivers. Official rhetoric frames it as fairness, but it exposes the fiscal hole left by vanishing fuel duty revenues.

The proposal emerges from Budget pressures demanding tens of billions in extra funds. Rachel Reeves, the Chancellor, faces a revenue shortfall as petrol and diesel sales decline with rising EV adoption. Since April, EVs have paid vehicle excise duty, ending a prior exemption set in the 2022 Budget under the Conservatives.

Government spokespeople insist the tax ensures equity, with fuel duty funding roads and services. They cite £4 billion in EV support, including grants up to £3,750 per vehicle, to ease upfront costs. Yet this new charge targets running costs, eroding one of EVs’ main attractions: lower operational expenses compared to fossil fuel cars.

Industry voices highlight the contradiction. The Society of Motor Manufacturers and Traders calls the measure a “strategic mistake” that burdens vehicles they must sell to meet zero-emission targets. Autotrader’s chief executive notes it removes the cost advantage of EVs, potentially stalling demand amid already sluggish sales.

Opposition figures echo the concern. Shadow Chancellor Mel Stride labels it a “tax raid” to fill a Labour-created fiscal void. Liberal Democrat Daisy Cooper decries it as unfair during a cost-of-living crisis, urging more charging infrastructure instead of penalties.

The revenue gap stems from policy design flaws spanning governments. Fuel duty generated £25 billion annually pre-EV shift, but exemptions and incentives accelerated the transition without a replacement mechanism. Now, with EV market share at 16% of new car sales, the Treasury scrambles, repeating patterns seen in past green policy U-turns like the scrapping of solar subsidies in 2011.

Hybrid drivers face a lower rate, but the system requires annual mileage estimates, credits for underuse, and top-ups for excess—a bureaucratic layer that adds complexity. Edmund King of the AA warns it risks becoming a “poll tax on wheels” unless balanced by fuel duty hikes on petrol and diesel. Such adjustments could boost EV uptake, but officials show no commitment.

This levy connects to wider economic strains. UK drivers already pay £40 billion yearly in vehicle taxes, yet road maintenance lags, with pothole repairs costing local councils £12 billion since 2010. The pay-per-mile idea, borrowed from trials in places like Oregon, ignores Britain’s infrastructure deficits, where EV charging points number just 50,000 against a needed 300,000 by 2030.

Citizens bear the brunt. An average driver covering 8,000 miles annually would pay £240 extra, hitting commuters and rural residents hardest. Low-income households, targeted by net-zero goals for emission cuts, see green choices priced out, widening inequality in access to sustainable transport.

Policy inconsistency persists across parties. Labour’s 2024 manifesto pledged no new taxes on working people while accelerating green investment, yet this proposal contradicts both. Conservatives introduced the VED change but now oppose the mileage tax, revealing shared fiscal shortsightedness.

The EV tax debate underscores institutional inertia. Governments chase short-term revenues over long-term planning, as seen in the 2015 diesel scandal that promoted then demonized high-emission vehicles. Without a stable funding model, the 2035 petrol ban looms as an empty deadline.

Britain’s green transition falters under repeated fiscal improvisation. This levy signals not progress, but desperation: a nation taxing its way out of environmental commitments while public services crumble. Ordinary drivers, pursuing cleaner options, find the path barred by the very policies meant to enable it.

Commentary based on EV drivers could face new pay per mile tax in Budget at BBC News.